How’s that for clickbait? No, really, I can help you triple your initial cash investment in a short 3 year period. Just read to the very bottom!

Today I want to share a little about how I analyze and underwrite real estate listings. You don’t need rocket science to look at deals and underwrite them. If you’re just starting out, there are nifty financial models that calculate financial projections at Biggerpockets that you could use. Link here https://www.biggerpockets.com/buy-and-hold-calculator. I’ve built my own though (Thank you past work experience!).

At the very least, I hope this post sparks some interest in real estate investing and/or equips you with the tools necessary to understand the basics of analyzing real estate deals.

Alright, let’s jump straight to it.

The basic terminologies used to underwrite investments

In the real estate investment industry, some of the basic financial metrics used are:

Return on Investment (ROI) or Cash on Cash return (CoC): Calculates your percentage returns on your initial cash investment in the deal, per year.

You purchase an apartment with $100,000 as down payment. Your net profit that year, after all expenses is $15,000 and thus 15% CoC return. This is the amount going straight into your pockets.

Capitalization Rate (Cap rate): The ratio of net operating income over value of the asset. Often used to gauge the price of the property based on the expected cash flow it will generate.

Cap Rate formula: Cap Rate (%) = NOI / Value of property

Coastal region properties tend to have lower cap rates than midwest properties as coastal real estate tends to be more speculative and appreciation-based while midwest real estate leans more on high cash flow and slower appreciation.

Internal rate of return (IRR) and Leveraged IRR: The most difficult and confusing of the 3, IRR calculates the discount rate on your investment where Net Present Value (NPV) equals 0. The IRR is very similar to ROI/CoC if calculated on a 1 year basis. However, long term IRR calculation is very different, albeit, subjective. IRR determines if a real estate project should even break ground. At times, it may be more profitable to invest elsewhere.

There are other investment financial indicators used as well, but these 3 are the most common.

Analysis Exercise

Starting small is what I tell new investors. Start with either condos, single family homes or duplexes and move up to 4-unit, 10, 50, 100, 200 unit apartments. You get the point. Even at the early stages, you can use ROI and Cap rates effectively to gauge investment returns. Don’t worry about the IRR for now.

In this analysis exercise, you can use the method to apply it to a $300,000 condo or a $2,000,000 10-unit apartment. This method of analysis will help you determine if the purchase will achieve your desired returns.

I will use a real listing for this analysis. It’s in Southeast Seattle, but I won’t disclose the property address since its actually off-market at this time and therefore the info isn’t made available to the public. PS – If you want to buy this property, come talk to me… it may be available to purchase off-market.

The power of Cap rates: Understanding how to drive the formula

Throughout this exercise, I want you to pay attention to the Cap Rate formula. Cap rates in Seattle can range between 4%-5% for this type of apartment (a little older, smaller, slightly desirable area). I’ve calculated the current cap rate for this property to be approximately 4.50% based on current income and expenses and value at $1.5M.

If you recall, Cap Rate (%) = Net Operating Income / Value of Property. Holding cap rate constant, any increase/decrease of the Net Operating Income will directly affect the value of the property. If you can generate an additional yearly income of $12,000, you have created $252,000 in property value (12,000/.0475=$252,000). Similarly, a reduction of yearly expenses by $5,000 equates to $105,000 of created property value.

When properly scaled to larger apartments, even a $25 increase in monthly rent can mean millions in created property value.

Below market rents

I’m a value-add type of guy – every deal must have plenty of “meat on the bone”, so to speak. This guarantees that I can cash flow positively on the investment regardless if the economy crashes. In your analysis, always be conservative with your numbers because an investment that cash flows negative on day 1 is NOT an investment.

Because this subject property is listed as a multifamily on the MLS, there’s usually some information about the current rental rates of the property. In this case, there are two 2bd units @ $1,600 and two 3bd units @ $2,200. Because I’m familiar with rental rates in this area, I know this is vastly under what other apartments charge. The question is, why?

Digging further, I found that 3 of the tenants are on month-to-month leases. This is a tell tale sign of long-term tenancy. The landlord prefers low turnovers so he keeps the rental rates below market and leases month-to-month rather than 12-month leases.

So what rents can I get immediately on day 1 of ownership? And what rents can I get if I fully renovate all the units? One happens instantly and the other happens over a span of 1-2 years. Right now, the rental rates are at the very bottom compared to similar apartments in the area. Similar 2bd apartment units are renting for $2,000 and 3bd units are renting for $2,800. That’s $2,000 per month you’re leaving on the table! (Remember what I said about the cap rate formula! This is $24,000/4.75% = $505,000 in created value.) Bear in mind, these rates for are similar looking apartments (interior finishes, appliances, exterior, and age of building) and not higher end apartments that charge a premium. In the following section, we’ll address how we can ride the coat tails of higher end apartments.

Forced Appreciation via Higher Revenue

Forced appreciation is the act of renovating, upgrading or adding an additional rentable unit to an apartment in order to command higher rents or build an additional revenue stream. Also consider charging for off-street parking, building out storage rooms to rent out, or provide washer dryers to the units where they previously did not have it (this is the case for the subject property).

In this case, if all the units are renovated, you can capture the rental gap between your current apartment and the premium high end apartments. This is a form of Forced Appreciation. Think of this as the 2-step process for increasing rents. The first iteration is to match competition (you’re under market rate). The second iteration is to ride just underneath the premium level apartments.

On the second iteration, you’re mimicking the finishes/appliances of the high end apartments, but offering slightly lower rents because you don’t have a lobby…or a pool…or a rooftop deck – Some tenants don’t want to pay for those extras, but still want the quality finishes/appliances and also be close to restaurants and bars. Your renovated apartment would be a great fit for them.

Forced Appreciation via Expense Reduction

Forced appreciation is achievable not only by increasing revenue, but also by reducing expenses.

If the landlord still pays for water/sewer/garbage, you can actually pass the expense to the tenants by applying utility bill-back programs such as RUBS (ratio utility billing system). Alternatively, you can also use a 3rd party sub-metering company to install meters to monitor individual usages and bill tenants that way. Sub-metering is beneficial if the property itself does not have existing individual meters for each unit. This is common in older buildings.

Low property taxes

Every piece of land in the city pays property tax. How this property tax is calculated is based on how much the city thinks your property is worth, the “Appraised Value”. The subject property is currently appraised by the city at a whopping $669,000 even though the list price is $1.5M. Does the city reassess your home’s value every year, especially after it sells? Every city reassesses value differently. In Seattle, they use the market approach. This means as similar homes in the area sell for higher prices, the city will readjust your home’s value accordingly to those sale prices. Even if the property sells for $1.5M, the reappraised value won’t jump up to $1.5M instantly. It will likely stagger-step up year-over-year to the appropriate value during the next 5-7 years.

How do we benefit? Lower than normal property taxes for the duration of your ownership of the property, assuming a 10-year hold. Currently, property taxes for this apartment is ~$6,000/yr. The property SHOULD be paying $10,000/yr. This is a savings of $4,000/yr until the appraised value catches up to the expected value of $1.2M-$1.5M. Over the span of 10 years ownership, you could be saving ~$30,000.

Follow the money

Brand new apartments are popping up everywhere in Seattle. New light rail stations. Transit oriented development. Where the city invests money, developers always follow. It’s a tried and true way of location, location, location.

The location of the 4-unit apartment is right next to an old USPS office which has now relocated. The old site has begun the construction of 240 new apartments plus ground floor retail. Currently, the area is not the best part of Southeast Seattle, but I believe the new apartments will soon improve the curb appeal of the area, attracting higher paying tenants with chic retail and restaurants. The subject property will benefit from the new development in ways of higher rents by targeting tenants who want to live in the area, but don’t want to pay for premium apartments.

As a bonus, the property is also a 10 minute walk to the Columbia City light rail station.

Final numbers and exit strategies

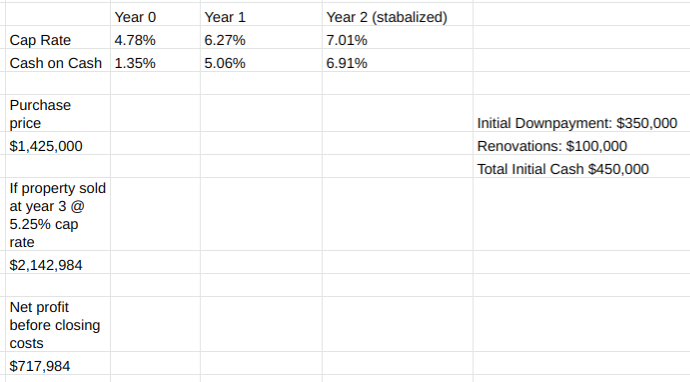

The list price is currently $1.5M for the 4-unit apartment. Obviously, it is negotiable and I would expect the sale price to be south of that number. Assuming I could acquire this property at $1.425M (5% off list price), these are the final numbers from my financial model:

***Year 0 means “Day 1” of ownership. Year 1 includes the bump up to market rate rents and Year 2 includes the final rent bump via renovation of the units.***

***I was conservative with the sale price based on the exit cap rate of 5.25% should the economy dip***

Assets – Liabilities = Equity: $2.1M(Asset) – $1M (Existing mortgage @ year 3) = $1.1M (Equity)

It will take 3 years to almost triple your initial down payment of $350,000 invested. Sounds great, right? But keep reading…

Exit Strategies (1031 exchange and 131 exclusion)

Because you’re selling after 2 years of ownership, your investment property qualifies for a 1031 exchange where you can defer your capital gains on the $700,000 profit you just made. If you decided to forgo the 1031 exchange and pay the capital gains, you would be on the hook for roughly $150,000 in taxes after the sale.

You can read more about the 1031 exchange in one of my previous posts.

If you really want to spice things up, consider living in one of the units and managing the other 3 on the property. Live there for 2 years, move out on the 3rd, rent your unit out, buy another property. Rinse and repeat. This is “house hacking” and many new investors start this way. Once the property is sold in year 3, up to $500,000 of the capital gains are exempt from capital gains taxes if you are married, and $250,000 if you are single. I’ve posted about this as well: Section 121 Exclusion. The remaining $400,000 will need to be deferred via the 1031 exchange. If you elect to pay the capital gains, you’d be on the hook for roughly $80,000.

The BRRRR Method

Buy, Renovate, Rent out, Refinance, and Repeat is the popular BRRR Method. You can read more about it here https://www.biggerpockets.com/blog/brrrr-buyrehabrentrefinancerepeatprimer

Now that you’ve bought the apartment, renovated it and if you elect to keep the apartment after the 3 years, you can cash out refinance your existing mortgage at year 3. I’m assuming a standard 25% down payment, 75% mortgage to purchase the property so your mortgage will be approximately $1M in year 3.

Assuming the mortgage rate is similar in 3 years, its safe to assume you can refinance the property at a 75% LTV (loan-to-value) or lower if you’re risk adverse. If the bank’s appraiser values the property at $2.1M in year 3 (I’ll admit this is an aggressive number, but can be offset by a higher LTV %), a refinance at 75% LTV equates to $1.5M. The new mortgage of $1.5M pays off the existing mortgage of $1M. You just made $500,000 to invest elsewhere and it was borrowed at a low interest rate. If you use this money as 25% down payment on your next purchase, you could afford up to $2M in a 2nd investment property and keep your 1st property. This is the power of leveraging your money.

OR

You can pocket the $500,000 and now you have $0 of your own money invested into this property (initial cash investment was $350,000 + $100,000 renovation budget). Essentially, you own a “FREE” investment property because you now have $0 of your own money invested into the property, actually, -$50,000… you were paid to own this property!

Conclusion

Even though these numbers look great, it comes down to the execution of the renovation and proper maintenance of the building. Extra, unforeseen expenses can cut into your profits. Before purchasing, taking a hard look at any possible large ticket expenses outside of your scope: condition of the balconies, perimeter landscaping, siding, roof, plumbing, electrical, etc. In 3 years the economy could also crash; in 10 years, no one knows what state the economy will be in. Assuming a 30% reduction in real estate prices, this analysis’ worst case scenario would be about break even after sale.

As always, real estate investing is not for everyone, especially the landlord aspect, dealing with property managers and contractors. Murphy’s law states that anything that can go wrong will go wrong – I can’t count how many headaches I’ve had dealing with 3rd parties. Conservative analysis is a must. There is high (but calculated!) risk because $450,000 cash is not something to take lightly, however, there is also high reward.

Congratulations for reading to the end, you made it. I hope you enjoyed this analysis and learned something new! If this opportunity interests you, hit me up!

As always, happy investing.

Disclaimer: Any information within this website is for informational purposes only and is not a substitute for obtaining accounting, tax, or financial advice from a professional. I do not guarantee that all the information above is correct. Online readers of this information are encouraged to seek out professional advice prior to performing any actions based on the information provided in this article.

Born and raised in the Pacific Northwest, I eat, sleep, and breathe real estate. As your agent, I’m attuned to your needs, knowledgeable of market trends and conditions, and dedicated to helping you reach your real estate goals. Buying a home is one of the biggest decisions in life, and it’s my passion to help you find the right home and to be on your side through the entire process.