Opportunity Zones summary:

- Opportunity Zones were introduced in the Tax Cuts and Jobs Act of 2017.

- Incentivizes investors investing in economically distressed communities.

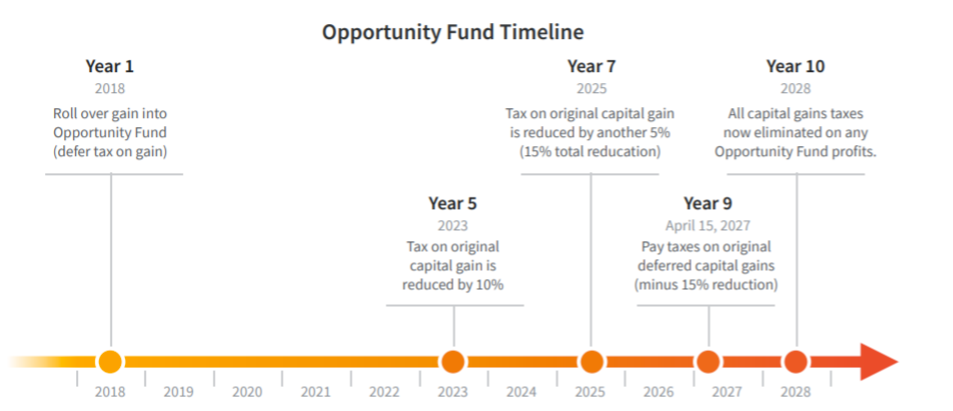

- Deferred capital gains: Reduction in capital gains tax realized for 5-7 year investments, and no capital gains taxes on gains from investments in Opportunity Zones when held for 10 years or more.

- Opportunity Zone Funds can invest in operating businesses, equipment, and real property.

Lately, I’ve been wrapping my head around the new Opportunity Zones program enacted by the Tax Cuts and Jobs Act in 2017 (TCJA) and thought I’d share what I have learned about this new tool for tax reduction strategies.

What are Opportunity Zones (OZ)?

The federal Tax Cuts and Jobs Act of 2017 was signed into law on Dec. 22, 2017. The Opportunity Zone program was included in that act, which was designed to provide tax incentives to investors who fund businesses in marginalized communities.

Investors are able to defer paying taxes on capital gains that are invested in Qualified Opportunity Funds that in turn are invested in distressed communities designated as Opportunity Zones by the governor of each state. Up to 25 percent of the low-income census tracts in each state can be designated as Opportunity Zones.

Below is a map of identified OZ tracts (highlighted in green). Our governor, Jay Inslee, designates which tracts are OZ.

Seattle OZ

Washington OZ

At first glance, I knew Rainier Valley would be categorized as OZ, along with Burien, SeaTac, and Sodo. With so many new developments in these areas, I can’t help but wonder if a majority of the investment capital stems from the OZ program. What you can’t see in these maps are areas labeled OZ in North Seattle. There is precisely none with the exception of a small patch in Lynnwood. It’s the age old North and South delineation where I-90 is the imaginary line drawn signaling a shift in median income, crime rates and demographics.

How does the Opportunity Zones program work?

Here’s a summarized list of how OZ’s operate.

- Qualified Opportunity Zones must be certified by the U.S. Department of the Treasury and required to hold at least 90 percent of their assets in qualified opportunity zone businesses and/or business property.

- To qualify, your capital gains must invest in a Qualified Opportunity Fund within 180 days of the date of the sale or exchange which created the gain.

- The tax deferral is temporary (up to nine years or before April 15, 2027, whichever is earlier) and the program ends on December 31, 2026.

- 5 year hold results in 10% reduction on original capital gain; 7 years results in 15% reduction.

- Today, the U.S. Department of the Treasury and the IRS released proposed regulations on Opportunity Zones designed to incentivize investment in American communities.

Below is a diagram visualizing how investing in an opportunity zone fund would look if your capital gains were rolled over in 2018. If you had invested in an opportunity fund today in 2019, your Year 5 (10% reduction) would be in 2024 and Year 7 (15% reduction) would be in 2026.

What does this mean for you and me?

The program ultimately benefits those with the means to invest in an opportunity fund. If a majority of your wealth generates from real estate, there is little benefit for you in Opportunity Zones.

The most benefit comes from selling stocks and securities. There is currently no way to defer or avoid capital gains when you sell you stocks and securities. Though an exception exists when you’ve sold stocks for a loss in previous years. Of course, we’re all good investors so that never happens, right?

When investing in an opportunity fund, you can choose to create and run the fund yourself (very complex). Alternatively, you could choose to invest via a real estate crowd source fund specializing in OZ sourced deals (easiest way). With the easy route, you must be an accredited investor. This means you have $1M in net worth (not including your primary home) or have a minimum of $25,000 one-time investment. Most who try to qualify will do so via the $25,000 minimum investment. The term “accredited investor” is a loose term so requirements may vary between institutions.

Recall that investing in OZ funds can only be done so via capital gains.

Example: Suppose you bought $100,000 worth of Apple stock in 2015 and sold it for $200,000 today. You’ve just realized $100,000 in capital gains and that amount would be eligible to invest in any OZ fund. If you elected to pay the taxes, you would owe $15,000 (Assuming you’re in the 22%-35% tax bracket). If you invest the $100,000 capital gains into the remaining years of the OZ program, your original capital gains of $100,000 would be reduced by 15%. In 2027, you must pay the capital gains tax of $12,750.

By year 10, assuming your initial $100,000 investment ends and you net an additional $150,000 upon sale, none of the $150,000 capital gains will taxed, a savings of $22,500!

Current Opportunity Zones projects in the PNW

Seattle’s Othello Square

Sprinkled among Seattle are many smaller OZ projects, but one notable OZ development called Othello Square stands out. The project sits on the corner of S Othello St and Martin Luther King Blvd where the land has been empty for some years now. The project will provide non-profit offices, open community space, medical clinic, affordable apartments, a 450 student high school, an education center, and other retail stores.

Tacoma’s Town Center Urban Village

In Tacoma, there are plans to build the Tacoma Town Center Urban Village (near UW Tacoma). The development will have over 600 apartments, 240,000 sqft of retail, an eSports Studio, and 90,000 sqft of office space.

Related: For more info on Othello Square and Tacoma Town Center Urban Village, see https://ndconline.org/wp-content/uploads/2018/11/WA-OZ_Community-Panel-Slides.pdf and their official website https://othellosquare.org/

Summary

Because the program is so new, funding of OZ funds has been slow. CPAs and lawyers have yet to determine the in’s and out’s of the program. Similarly, the effects of the OZ program have yet to be seen as well. Many of the large OZ development projects aren’t locally funded. Likely, the capital is raised on a national level and by corporations looking to avoid paying capital gains taxes.

However, if the IRS offers such tools to investors like you and me, I wouldn’t hesitate to leverage the program. Do your due diligence and see if investing in an OZ fund can benefit you now and in the future. If you have large capital gains from stocks which you want to defer, an OZ fund could be the answer you’re looking for. If you’re looking to defer real estate capital gains, a 1031 exchange will still be the better option.

Related: Read more about the 1031 Exchange here!

I’d love to chat with anyone about OZ and any potential opportunities relating to OZ funds. If you’ve read this far, thank you for sticking around on such a dense topic and until next time, happy investing.

Disclaimer: I am not an accountant or expert in the US tax code. Any information within this website is for informational purposes only and is not a substitute for obtaining accounting, tax, or financial advice from a professional. Online readers of this information are encouraged to seek out professional advice prior to performing any actions based on the information provided in this article.

Born and raised in the Pacific Northwest, I eat, sleep, and breathe real estate. As your agent, I’m attuned to your needs, knowledgeable of market trends and conditions, and dedicated to helping you reach your real estate goals. Buying a home is one of the biggest decisions in life, and it’s my passion to help you find the right home and to be on your side through the entire process.